wells fargo class action gap

Wells Fargo was hit with a class action lawsuit in March 2018. An order granting final.

Received A 4300 Check From Wells Fargo And A Letter Admitting That They Wrongfully Repossessed My Father S Vehicle That I Was A Cosigner On 5ish Years Ago R Personalfinance

Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP.

. How Much Will I Get From Wells Fargo Gap Settlement. 2 the customer chose to finance the cost of the. WELLS FARGO AGREES TO 500M GAP FEES SETTLEMENT.

If your vehicle was repossessed related to CPI there is additional compensation provided by Wells Fargo as part of the Allocation Plan and the option to participate in third-party mediation. This settlement could result in 500 million for the plaintiffs. Closed class action settlements are class action lawsuits that are no longer accepting claims.

The Settlement resolves a class action lawsuit against Wells Fargo in the United States District Court for the Central District of California Armando Herrera et. Consumers who paid off their car loans early and were allegedly subject to improper Wells Fargo GAP or guaranteed auto protection insurance fees may be eligible to benefit from a class action settlement worth as much as 500 million. Banking giant Wells Fargo has agreed to pay close to 80 million in refunds and costs as well as make changes in business practices valued at hundreds of millions of dollars to settle a class action lawsuit over allegedly improper fees charged to auto loan customers.

Leave a Comment. It is worth noting that Wells Fargo has agreed to shell out 500 million as the main settlement fund to end the Wells Fargo GAP Insurance Class Action Lawsuit litigation process. Wells Fargo Bank NA Case No.

A federal judge on Monday approved 231 million in attorney fees in a class action over Wells Fargos auto insurance gap coverage program a final step in a. And National General Insurance Company collectively Defendants alleging that between October 15 2005 and September 30 2016 Defendants unlawfully placed collateral protection insurance CPI policies on Class. This settlement resolves a lawsuit against Wells Fargo Bank NA Wells Fargo Co National General Holdings Corp.

In a settlement customers who are entitled to benefit from a class action settlement valued as much as 500 million may receive up to 500000 in additional compensation because of improper Wells Fargo GAP or guaranteed auto protection in the course of paying off their car loans early. Wells Fargo says it has set aside 8 million to remediate the wrongful disclosures caused by the software miscalculation. This is inclusive of refunds Wells Fargo made to consumers in other states totaling 824 million.

Wells Fargo will pay 500 million to end a class action lawsuit refunding US. 5 hours ago Wells Fargo will pay 500 million to end a class action lawsuit refunding US. Consumers who paid off their car loans early and were allegedly subject to improper Wells Fargo Guaranteed Auto Protection insurance fees then you are eligible for a potential award from the Wells Fargo GAP Insurance Class Action Lawsuit.

Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees. Filed by plaintiff Armando Herrera and others in a California federal court the aforementioned class action centered upon the claims that Wells Fargo did not pay back their car loan. 1 the Approved Claims for GAP Refunds to the Non-Statutory Subclass Members.

Specifically these customers were charged unnecessary fees for auto insurance because the company did not provide adequate customer service. 13 2022 Published 237 pm. If you have not received a refund from Wells Fargo for the unused portion of your GAP coverage you may be a potential class member in the pending class action lawsuit against Wells Fargo case no.

Wells Fargo to Pay 500M to Settle GAP Insurance Fees. This settlement resolves a class action against Wells Fargo Bank NA on the subject of Guaranteed Asset Protection or Guaranteed Auto Protection GAP. If you financed the purchase or lease of a vehicle with Wells Fargo and your loan included GAP coverage you may be entitled to damages.

Meanwhile Distribution Plan payments are being issued by. The Class and the Statutory Subclass. The lawsuit alleged that Wells Fargo was keeping the GAP insurance money when it was obligated to return it.

Split amongst the 545 people Wells Fargo says it wrongfully foreclosed on that would amount to only about 14500 per person. 3 the Fee and Expense Awards to Class Counsel approved by the Court. The Wells Fargo GAP class action lawsuit was filed by 15 Wells Fargo car loan customers who all claim that they terminated.

And 4 any Service Awards to the Class. Wells Fargo will establish a settlement fund Settlement Fund totaling 4500000000 to pay. A class-action lawsuit was filed against Wells Fargo over the fees associated with GAP insurance.

November 16 2021 at 0224 PM. GAP offers extra protection beyond that provided by typical auto insurance policies in event of a total loss of the vehicle. But reportedly the checks Wells Fargo is sending out are lower than that.

Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP insurance coverage. The lawsuit alleges that Wells Fargo failed to provide customers with a partial refund of the fees paid for Guaranteed Asset Protection or Guaranteed Auto. Wells fargo to pay 110 million to settle class.

Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees. 2 the 500 Additional Compensation payments to the Statutory Subclass Members. Wells Fargo GAP Wells Fargo agreed to a 45 million settlement over allegations of failing to refund GAP fees after borrowers paid off their finance agreements early.

Wells Fargo GAP Insurance Lawsuit and Settlement. Wells Fargo Gap Insurance. According to the lawsuit plaintiffs in the Western Digital class action lawsuit alleged that Wells.

Wells Fargo Cuts Overdraft Fees After Settling a Class-Action Lawsuit By Jennifer Farrington. 28 2020 Colorado received confirmation from Wells Fargo that it had completed restitution to Colorado consumers of unearned GAP premiums collected by Wells Fargo. Borrowers who entered a finance agreement with GAP agreements assigned to Wells Fargo and had an early payoff during the class period and did not receive a GAP refund may be eligible for cash payment.

Two Classes have been certified in this settlement. In total Wells Fargo refunded 958095036 on 51434 accounts to Colorado consumers. The class-action settlement agreement covered all persons who claimed that Wells Fargo opened an unauthorized consumer or small business checking or savings account or an unsecured credit card or line of credit between May 1 2002 and April 20 2017.

Wells Fargo Agrees To Settle Auto Insurance Suit For 386 Million The New York Times

Wells Fargo Class Action Lawsuit And Latest News Top Class Actions

Wells Fargo To Pay 500m To Settle Gap Insurance Fees Class Action Top Class Actions

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

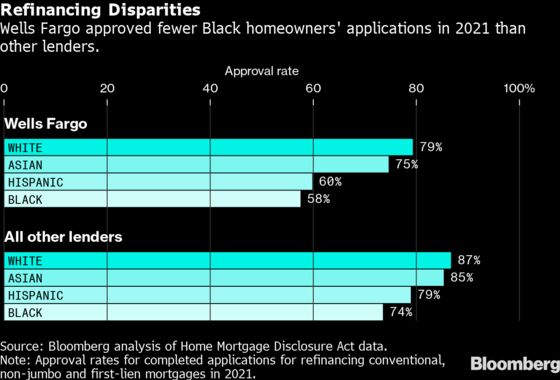

A Black Homeowner Is Suing Wells Fargo Claiming Discrimination The New York Times

Wells Fargo Hit With Lawsuit Due To Allegations Of Discriminating Against Black Homeowners The Shade Room

Folks There Are Over 800 Comments I Hate Wells Fargo Facebook

I Actually Got A Refund From Wells Fargo For The Rate Lock Lawsuit R Personalfinance

Wells Fargo Gap Insurance Settlement Armando Herrera V Wells Fargo

Wells Fargo Refund Of Gap Fees Settlement

Wells Fargo Faces Persistent Racial Gap In Mortgage Refinancing

Did You Receive A Gap Refund From Wells Fargo Top Class Actions

Wells Fargo Faces Persistent Racial Gap In Mortgage Refinancing

Wells Fargo Gap Insurance Class Action Settlement Top Class Actions

Q A Wells Fargo Seeks To Bridge The Gap Between Growers And Tech Afn

Wells Fargo Cipa Settlement 28m For Calls Recorded Without Consent

Wells Fargo Checking Account Class Action Attorney Franklin D Azar Associates P C