lincoln ne sales tax 2019

The state sales tax rate in Nebraska is 55 but you can customize this table as needed. Several local sales and use tax rate changes will take effect in Nebraska on January 1 2019.

Nebraska Income Tax Ne State Tax Calculator Community Tax

Heres how Lincoln Countys maximum sales tax rate of 7 compares to other counties around the United States.

. The Nebraska sales tax of 55 applies countywide. On January 16 2019 AFP lifted Lincolns negative sales tax increase. The December 2020 total local sales tax rate was also 7250.

This is the total of state and county sales tax rates. Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on July 1 2019. However as a result of an affirmative vote in the November 6 2018 election Pender will impose a new city sales and use tax at the rate of 15 but it will not be effective until April 1 2019.

Lower maximum sales tax than 77 of Nebraska counties. Raised from 55 to 725 Hershey Brady Maxwell Wellfleet and Dickens. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

North Platte NE. A no vote was a vote against authorizing the. Ballot Question April 9 2019.

This is the total of state county and city sales tax rates. Nebraska Department of Revenue. 8292019 82837 AM.

The Nebraska state sales and use tax rate is 55 055. January 2019 sales tax changes. Shall the City Council of Lincoln Nebraska increase the local sales and use tax rate by an additional one quarter of one percent ¼ upon the same transactions within such municipality on which the State of Nebraska is authorized to impose a tax for a period of six years for street.

Effectively Pender will not have a local sales. 555 South 10th Street Suite 205 Lincoln NE 68508 402-441-7606 lincolnnegov DATE. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

2020 rates included for use while preparing your income tax deduction. AP - Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state. For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate.

It was approved. Some cities and local governments in Lincoln County collect additional local sales taxes which can be as high as 15. The Nebraska state sales and use tax rate is 55 055.

Lincoln on the Move. 2022 Nebraska Sales Tax Changes. For more information on sales tax visit the Nebraska website.

Rates include state county and city taxes. January 2019 sales tax changes. 555 South 10th Street Room 110 Lincoln NE 68508 RE.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725. There is no applicable county tax or special tax.

800-742-7474 NE and IA. City of Lincoln Transportation and Utilities Created Date. By 2021 the total will triple to 53 with the Lincoln Division accounting for just 217 of the bill total tax.

The Nebraska sales tax rate is currently 55. POTENTIAL USE OF QUARTER CENT SALES TAX FOR THE MINIMUM 25 FOR NEW CONSTRUCTION TO PROMOTE PRIVATE SECTOR INVESTMENT. 2019 at 547 PM CDT Mere days after a ballot sales tax question was passed by voters.

Norfolk NE Sales Tax Rate. ACT Meeting August 29 2019 - Summary of Potential Use of Quarter Cent Sales Tax for New Construction Subject. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

A new 05 local sales and use tax takes effect bringing the combined rate to 6. The Lincoln sales tax rate is 175. For tax rates in other cities see Nebraska sales taxes by city and county.

McCook NE Sales Tax Rate. Lincoln Details Lincoln NE is in Lancaster County. Did South Dakota v.

The current total local sales tax rate in Lincoln NE is 7250. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. Over the past year there have been nineteen local sales tax rate changes in Nebraska.

April 30 2020. Nebraska City NE Sales Tax Rate. A new 05 local sales and use tax takes effect bringing the combined rate to 6.

The latest sales tax rates for cities in Nebraska NE state. Average Sales Tax With Local. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

More are slated for April 1 2019. The Lincoln County sales tax rate is. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Check out our new state tax map to see how high 2019 sales tax rates are in your state. Groceries are exempt from the Nebraska sales tax. Lincoln drove this change by decreasing its sales tax from 15.

The minimum combined 2022 sales tax rate for Lincoln County Nebraska is. The 2018 United States Supreme Court decision in South Dakota v. Lincoln NE 68509.

2019 Tax Increment Financing Report for the City of Lincoln In March of 2018 Governor Ricketts signed into law an amendment to the Nebraska Community. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements. What is the sales tax rate in Lincoln Nebraska.

A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. View a list of national sales tax rate changes for other. Has impacted many state nexus laws and sales.

The County sales tax rate is 0. Nebraska Sales Tax Rate Finder. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

Of their total sales and will. Nebraska saw the largest decrease in sales taxes this year improving its combined state and local sales tax ranking by two spots. State and local sales tax rates as of January 1 2019.

Several local sales and use tax rate changes took effect in Nebraska on January 1 2019. Lincoln NE Sales Tax Rate. You can print a 725 sales tax table here.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. The Nebraska state sales tax rate is currently. October 1 2019 -- December 31 2019.

Lincoln voters passed the sales tax increase by a slim 650-vote margin and is set to go into effect Oct. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated 03032022 There are no changes to local sales and use tax rates that are effective July 1 2022. There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

Nebraska Income Tax Ne State Tax Calculator Community Tax

Vehicle And Boat Registration Renewal Nebraska Dmv

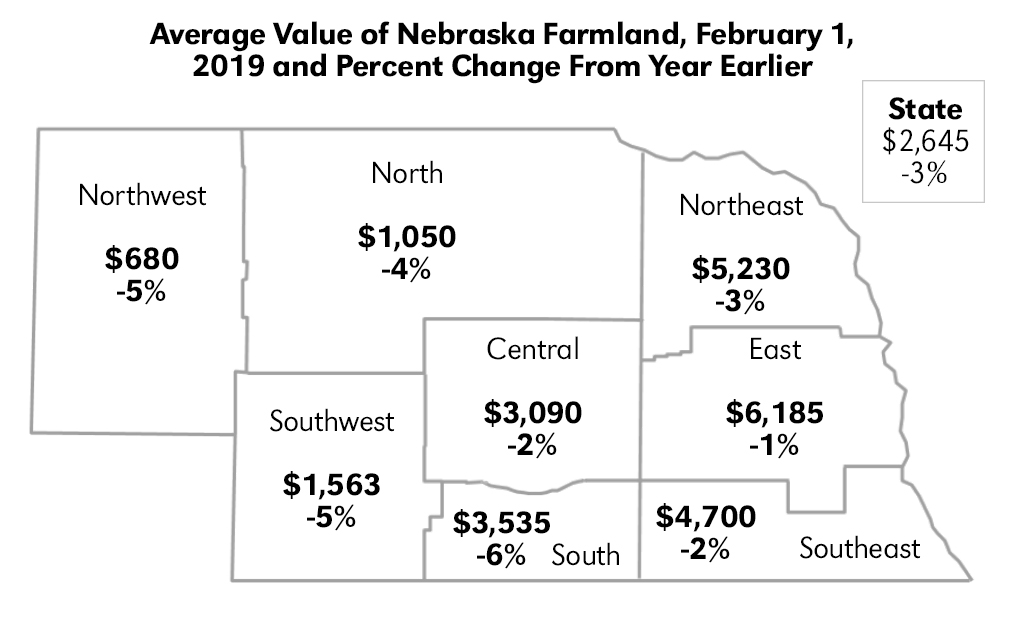

2019 Nebraska Farm Real Estate Report Agricultural Economics

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

Nebraska Income Tax Ne State Tax Calculator Community Tax

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

File Sales Tax By County Webp Wikimedia Commons

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2019 Nebraska Property Tax Issues Agricultural Economics

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders